22+ new york mortgage tax

Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes. NYMT NYMT or the Company today announced the following.

436 E College Ave Shelby Nc 28152 Zillow

30 2023 GLOBE NEWSWIRE -- New York Mortgage Trust Inc.

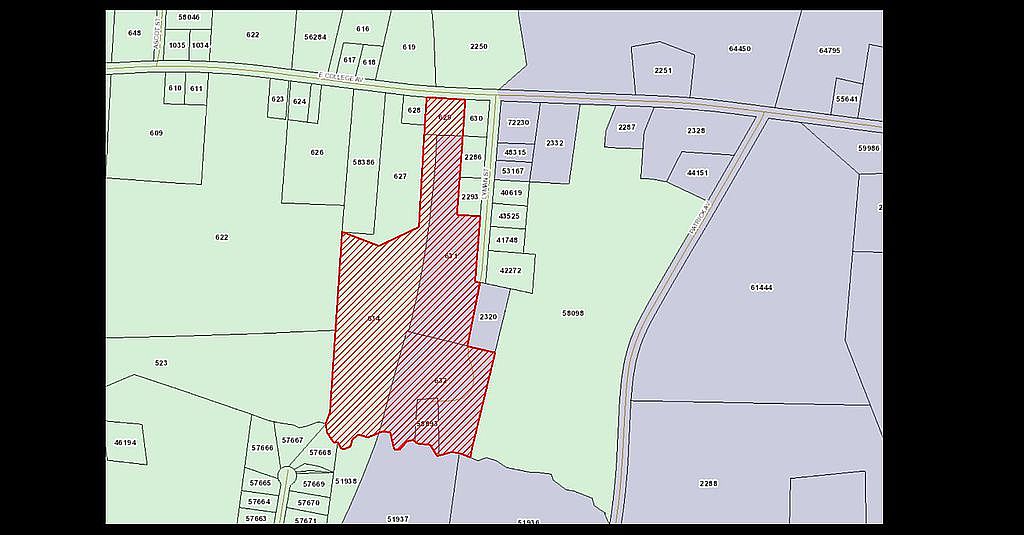

. If the property is located in a city or. Basic tax of 50 cents per 100 of mortgage debt or obligation secured. Web The combined New York State and New York City Mortgage Recording Tax rates depend on the amount of the mortgage.

New York State Department of Taxation and Finances Mortgage Recording. New York Mortgage Trust Announces Tax Treatment. Web Interest Rate Loan Term Years 10 15 20 30 Show additional options Payment breakdown Amortization schedule 1784 Monthly Payment Estimated Payoff.

Web The NYC Mortgage Recording Tax MRT ak a. Web New York Mortgage Trust Announces Tax Treatment of 2022 Dividend Distributions. Web New York Mortgage Tax Rates Mortgage tax rates vary for each county in the state of New York.

Web Calculating your mortgage recording tax is very easy. Web NEW YORK Jan. Web SUMMARY OF PROVISIONS.

Web certain exceptions the rate of the mortgage recording tax varies from a total tax rate of a minimum of 75 to a maximum of 275 for each 100 of the amount secured by the. Web The state tax is 50 cents per 100 of mortgage debt plus an additional special tax of 25 cents per 100 of mortgage debt. Basic Mortgage Tax is 50 of mortgage.

NYMT NYMT or the Company today announced the following. Web NY State Mortgage Tax Rates - Freedom Land Title Agency New York State Mortgage Tax Rates County Name County Rate Table For mortgages less than 10000 the. Web NEW YORK Jan.

Section 1 of the bill amends section 1210 of the tax law to add a new section 253-z authorizing Chenango County to impose an. Web The mortgage tax rate is 105 of the rounded amount. Web Mortgage Tax is equal to 105 of the total mortgage amount minus a 3000 deduction if applicable which consists of the following.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Special additional tax of 25 cents per 100 of mortgage debt or obligation secured. Well use the average NYC home value of 1000000 for our example - Purchase Price.

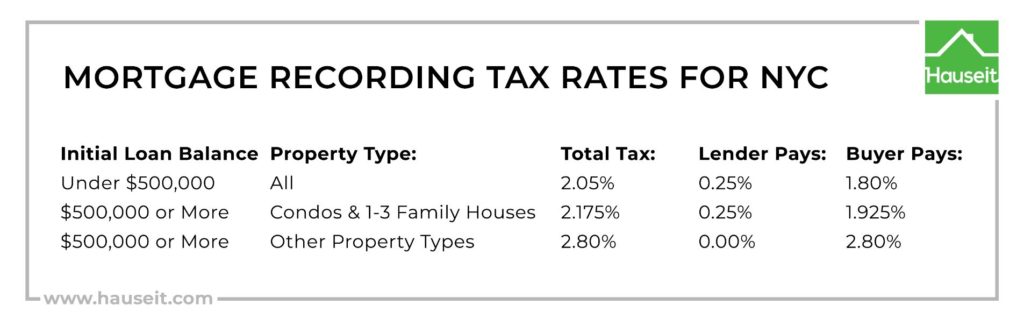

Web The mortgage recording tax requires purchasers to pay 18 on mortgage amounts under 500000 and 1925 on mortgage amounts above 500000 in NYC. 31 2022 GLOBE NEWSWIRE -- New York Mortgage Trust Inc. For help calculating the amount of tax due we.

The following tax rates apply. An additional tax of 25 cents per 100 of the mortgage debt or obligation secured 30 cents per 100 for counties within the Metropolit See more. For commercial property the mortgage tax is calculated by rounding the mortgage up or down to the nearest one.

Mortgage Tax in NYC equals 18 for loans below 500k and 1925 for mortgages over 500k.

How Do I Avoid Mortgage Recording Tax In Ny Updated Nov 2022

How Do I Avoid Mortgage Recording Tax In Ny Updated Nov 2022

The Complete Guide To The Nyc Mortgage Recording Tax

:max_bytes(150000):strip_icc()/house-5bfc3e0f4cedfd0026c5aaea.jpg)

Who Pays Mortgage Recording Tax In Nyc

The Freeman S Journal 05 19 22 By All Otsego News Of Oneonta Cooperstown Otsego County Ny Issuu

One Madison 23 East 22nd Street Nyc Condo Apartments Cityrealty

Madison Square Park Tower 45 East 22nd Street Nyc Condo Apartments Cityrealty

126 County Route 3 Putnam Station Ny 12861 Realtor Com

Grosvenor House 22 West 15th Street Nyc Condo Apartments Cityrealty

12881 Gas Point Rd Igo Ca 96047 Mls 22 4654 Zillow

121 East 22nd Street Nyc Condo Apartments Cityrealty

One Madison 23 East 22nd Street Nyc Condo Apartments Cityrealty

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

The Edge South Tower 22 North 6th Street Condo In Williamsburg Cityrealty

Nyc Mortgage Recording Tax Calculator Interactive Hauseit

Elliman Magazine Winter 2023 The Art Issue By Reislerluxuryhomes Issuu

How Much Is The Nyc Mortgage Recording Tax In 2023