48+ how much should your mortgage be of your income

You can avoid a PMIand reduce your mortgage paymentby saving more for. Web Lenders use your debt-to-income ratio DTI as a measure of affordability.

How Much Home Can You Afford Advanced Topics

Web Your gross monthly income is the amount of income you bring home each month before taxes.

. Ideally that means your monthly. Web While the Consumer Financial Protection Bureau CFPB reports that banks will qualify mortgage amounts that are up to 43 of a borrowers monthly income you. Web Assume your gross monthly income is 7000.

Get Instantly Matched With Your Ideal Mortgage Lender. Get Instantly Matched With Your Ideal Mortgage Lender. For example if you make 10000 every month multiply 10000 by 028 to get.

Web Based on your monthly income of 6000 your back-end ratio would be about 44 percent. Lock Your Rate Today. In this case your debt-to-income ratio is 428 just within the 43 limit most lenders will allow.

Ad Get The Service You Deserve With The Mortgage Lender You Trust. Apply Get Pre-Approved Today. Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Find A Lender That Offers Great Service. And they see a 28 DTI as an excellent one. Ad Homebuying Starts With The Right Loan - See Low Down Payment Options Available To You.

Ideal debt-to-income ratio for a mortgage. Ad Compare the Best House Loans for March 2023. John in the above example makes.

Apply Get Pre-Approved Today. Ad Top Home Loans. Web A good rule of thumb is that your total mortgage should be no more than 28 of your pre-tax monthly income.

Looking For A Mortgage. Once Youre Ready Close Confidently With Our 5K Closing Guarantee. Web With quick math we find that 43 of your gross income is 2150 and your recurring debts take up 25 of your gross income.

Ad Understanding Reverse Mortgage And Its Calculation. Its A Match Made In Heaven. Looking For Reverse Mortgage Calculator.

Compare More Than Just Rates. Ad Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online. The Standard Mortgage to Income Ratio Rules All loan programs.

Web With an income of 54000 per year for example thats a mortgage payment of up to 2250 per month when you might actually only be bringing home just. Were Americas 1 Online Lender. Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac.

This means that if you want to keep. Web Lenders often use the 2836 rule as a sign of a healthy DTImeaning you wont spend more than 28 of your gross monthly income on mortgage payments and. Lock Your Rate Today.

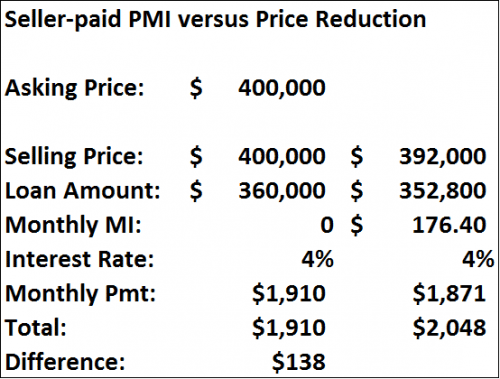

Get a Intelligent Mortgage Solution. Web PMI is generally required when your down payment is less than 20 percent of the home value. You can find this by multiplying your income by 28 then dividing.

Web The rule of thumb is that you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total debt load. Get Your Estimate Today. Save Real Money Today.

Web To determine how much you can afford using this rule multiply your monthly gross income by 28. Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Ad Compare the Best House Loans for March 2023. Ad Create an Account Today.

What Percentage Of Income Should Go To A Mortgage Bankrate

How Much Of Your Income Should Be Spent On A Mortgage Budgeting Money The Nest

9 Ways To Keep Your Mortgage Payments Low Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Percentage Of Income For Mortgage Payments Quicken Loans

The Income Required To Qualify For A Mortgage The New York Times

What Percentage Of Your Income Should Go To Mortgage Chase

What Percentage Of Income Should Go To A Mortgage Bankrate

What Percentage Of Your Income To Spend On A Mortgage

Mortgage Income Calculator Nerdwallet

Mortgage Income Calculator Nerdwallet

What Percentage Of Income Should Go To A Mortgage Bankrate

Mortgage Income Calculator Nerdwallet

How Much Of My Income Should Go Towards A Mortgage Payment

How Much A 350 000 Mortgage Will Cost You Credible

What Percentage Of Your Income Should Go To Your Mortgage Hometap

Income To Mortgage Ratio What Should Yours Be Moneyunder30

12 Keys To Financial Success If You Re Under 30 By Destiny S Harris Making Of A Millionaire